Brooklyn is home to 2.6 million people. Some swear homeownership is the best option in the borough while others love the flexibility renting offers. Should you buy or rent in Brooklyn? With an average rent of $2,593 a month and an average home price of $669,320, the decision is tough.

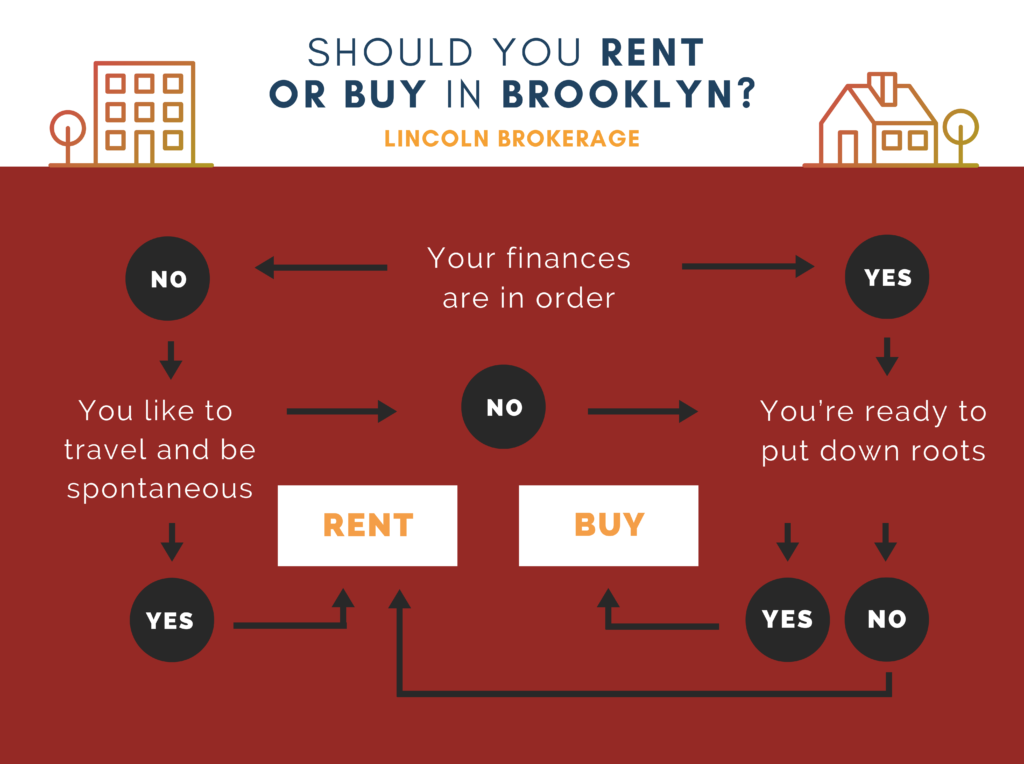

Deciding if you should rent or buy is a personal journey. But there are a few signs you can look out for to help uncover the answer.

4 Signs to Buy in Brooklyn

1. Your finances are in order

No, an organized wallet is not a sign of organized finances. But if you’ve managed to pay off all your student loans and credit card debt, have a rocking credit score (you’ll need a credit score of at least 620 for a conventional bank mortgage loan), and solid savings with an emergency fund on the side, it may be time to consider buying a home in Brooklyn.

If you don’t already have a down payment saved, start putting away money before applying for a loan. Once you’re pre-approved, you’ll know how much house you can afford and the minimum amount you’ll need for a down payment.

2. You have a steady job

Trying to find your way in the working world takes time. But once you’ve decided you’re in the right industry and you have the skills required to advance as opportunities arise, you’re in a good position to buy a house.

A common misconception is that you need to be at a job for a certain period of time before a bank will approve you for a loan. You do have to provide work history for the previous two years when applying for a mortgage, but it’s okay if you’ve switched jobs during this time period.

3. You’re ready to put down roots

If you’re part of the millennial generation, chances are you value travel. Research shows that millennials are traveling more than Gen X or Baby Boomers, which could mean funds that could be put towards a down payment or mortgage are instead being used to backpack through Europe.

Having the ability to travel is a gift and one that should be used if possible. So if you’re more into packing a suitcase than packing moving boxes, that’s okay. But if you’ve seen the sights and have decided Brooklyn is where you want to hang your hat for a while, homeownership could be the next step.

4. You understand the steps and hidden costs of buying a home

Going from renter to owner isn’t easy. Understanding how to apply for a mortgage will prevent mishaps and embarrassment while knowing what you’re looking for in a house will save time and prevent disappointment.

Are you familiar with closing costs, property taxes, hoa fees, and homeowners’ insurance? Are you prepared to handle emergency repairs and upgrade your home? Brooklyn’s famous brownstones are known for lengthy renovation processes and hidden costs, though owning a piece of architectural history is priceless.

Benjamin Franklin never went open house hopping in Brooklyn, but he got it right when he said, “An investment in knowledge pays the best interest.” In other words, taking the time to learn everything you can about the home buying process is a sure-tell sign you’re ready.

3 Signs to Rent in Brooklyn

1. Your credit score needs some work

Experian estimates that 30% of Americans have poor or bad credit. If you’re one of them, the good news is you’re not alone. The bad news is that it could be nearly impossible to secure a mortgage loan.

However, a credit score isn’t permanent. And renting can actually improve your credit score. Take some time to settle into an apartment, develop and stick to a budget, and build up your savings. Even if you decide renting is better than buying, you’ll be in a better financial spot than you were when you first signed your lease.

2. You like to be spontaneous

One of the best benefits of renting in Brooklyn is the ability to be spontaneous. If you enjoy last-minute opportunities more than a schedule, renting might be the better option.

Renting allows you to say yes to a new job, book that 6-month cruise, or move across the country to be with your significant other. While all of these opportunities are available to homeowners, making them happen takes more time and effort.

3. Homeownership isn’t your goal

Even if renting makes you feel uneasy, the idea of homeownership might not appeal to you. A recent article from CNBC.com revealed that two out of every three millennial homebuyers have regrets about their big purchases. Reasons for their disappointment include the hidden costs, less than ideal locations, and homes that just don’t meet their needs. While renting can prove to be disappointing in its own ways, it’s a lot easier to pack up and move to a new apartment than it is to sell and buy.

Maybe your financial goals aren’t so cookie cutter. And that’s okay. But if your gut tells you homeownership sounds more like a nightmare than the American Dream, renting is surely the better option for you.

Should You Buy or Rent in Brooklyn?

The decision is ultimately up to you. And just because renting is the right answer today doesn’t mean homeownership isn’t in your future and vice versa.

If you want to call Brooklyn home, there’s a way to do just that.